F&NHB Posts Resilient Performance for FY2025

- The Group registered stable performance, recording RM5.2 billion in full year revenue and profit growth momentum amid global and regional volatility.

- FY2025 Group operating profit and profit before tax grew 5.1% and 4.8% respectively, supported by lower input costs and operational discipline.

- The good performance partially mitigated the higher income taxes following the full utilisation of promotional privileges for a subsidiary in Thailand in the previous financial year and the dairy farm’s start-up costs. FY2025 Group profit after tax eased by 5.4% to RM514.7 million.

- F&B Malaysia posted higher FY2025 revenue of RM2.96 billion supported by stronger export momentum. F&B Indochina’s FY2025 revenue eased 2.6% (2.3% in THB terms) year-on-year, reflecting temporary headwinds from reduced tourism activity in Thailand, and export disruptions amid regional tensions.

- The development of the dairy manufacturing plant is nearing completion at Pasir Besar, with commercial milk production slated for Q1 FY2026. F&N AgriValley now houses over 4,000 cattle, with another 2,500 heifers arriving in November. Cropping activities are in full swing across F&N AgriValley.

- The new beverage plant in Butterworth, Penang commenced operations in August 2025 and is producing carbonated soft drinks and drinking water for markets in Northern Peninsular Malaysia.

- Recommending a final single tier dividend of 35.0 sen per share (FY2024: final dividend of 33.0 sen per share) amounting to RM128.4 million (FY2024: RM121.0 million).

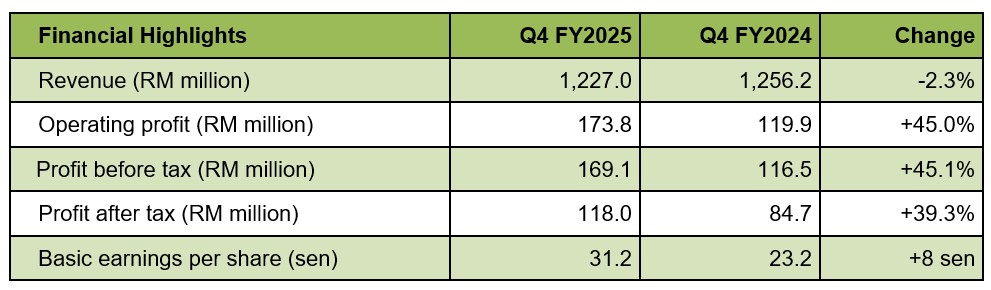

FOURTH QUARTER FY2025 PERFORMANCE

Fraser & Neave Holdings Bhd (‘F&NHB’ or ‘the Group’) delivered a resilient performance in its fourth quarter ended 30 September 2025 (Q4 FY2025), recording revenue of RM1.23 billion compared to RM1.26 billion in the corresponding quarter last year, amid a challenging global environment marked by geopolitical tensions and market uncertainties.

Food & Beverage Malaysia (F&B Malaysia) recorded a robust 9.1% revenue growth in Q4 FY2025 compared to the same period last year, driven by well-executed trade and marketing initiatives, solid performance across all channels and higher export sales. Meanwhile, Food & Beverage Indochina (F&B Indochina) experienced a 15.4% (16.8% in THB terms) decline in Q4 revenue, as softer tourism, flooding in northern provinces of Thailand, and export disruptions to Cambodia and Myanmar weighed on sales.

Group operating profit for Q4 FY2025 rose 45.0% year-on-year to RM173.8 million (Q4 FY2024: RM119.9 million), supported by lower input costs and improvement in operational efficiencies.

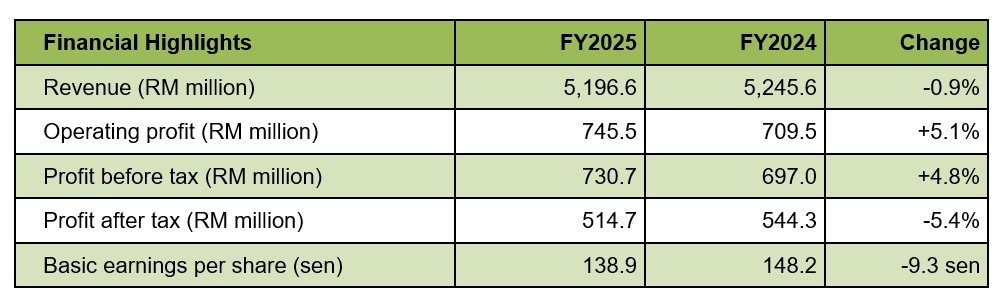

FY2025 FULL YEAR PERFORMANCE

The Group ended FY2025 on a firm footing, sustaining revenue performance and profit growth momentum amid global and regional volatility. For the financial year ended 30 September 2025 (FY2025), the Group recorded revenue of RM5.2 billion, marginally below last year, reflecting its agility and the underlying strength of its core businesses.

F&B Malaysia posted higher revenue of RM2.96 billion in FY2025 compared to RM2.95 billion last year, supported by stronger export momentum. Meanwhile, F&B Indochina’s FY2025 revenue eased 2.6% (2.3% in THB terms) year-on-year, reflecting temporary headwinds from softer tourism in Thailand, and border closures amid regional tensions.

Group operating profit and profit before tax for FY2025 increased by 5.1% and 4.8% respectively year-on-year, supported by lower input costs and enhanced operational efficiencies across markets. Stronger contributions from existing business units also helped cushion the impact of the dairy farm’s start-up costs, underscoring the Group’s resilience and strength across its core operations.

This performance was bolstered by F&B Indochina, which saw its operating profit for FY2025 rise to RM474.6 million (FY2024: RM449.9 million) while F&B Malaysia delivered operating profit of RM280.3 million (FY2024: RM305.4 million).

Despite higher profit before tax, Group profit after tax for FY2025 declined by 5.4% year-on-year primarily due to higher income tax expense following the full utilisation of promotional privileges for a subsidiary in Thailand in the previous financial year.

Commenting on F&NHB’s full year performance, Lim Yew Hoe, Chief Executive Officer of F&NHB said, “F&NHB’s performance across FY2025 underlines the importance of our strategy to capture value across all business activities. It also reflects the Group’s resilience and agility in maintaining stability amid a challenging environment for our core businesses, while advancing the development of our integrated dairy farm to drive future growth.”

KEY CORPORATE DEVELOPMENTS

At the Group’s 2,000-acre integrated dairy hub, F&N AgriValley, development of the dairy manufacturing plant is nearing completion with commercial milk production slated for Q1 FY2026, marking an exciting phase in the Group’s journey towards upstream dairy integration. Located in Pasir Besar, the farm now houses over 4,000 cattle — including lactating cows, pregnant heifers and calves — thriving in modern, climate-controlled barns designed to optimise animal comfort and productivity. This month (November), an additional 2,500 pregnant heifers from Chile are scheduled to arrive, further expanding the herd and accelerating milk production under the Magnolia Brand.

Concurrently, cropping activities are in full swing across F&N AgriValley. Corn silage harvesting is ongoing, while development of the second parcel at Bukit Londah is progressing on schedule, with sorghum and corn planting targeted for FY2026 to support feed self-sufficiency that is consistent and locally produced to meet the demands of the expanding herd.

Lim added, “We are pleased with the rapid progress at F&N AgriValley which is, to date, among the lowest carbon footprint integrated dairy farms in the region. Water from our reservoirs supports irrigation through centre pivots, while animal waste is recycled back into the land as organic fertiliser — demonstrating our commitment to sustainable, circular farming practices.”

Regionally, progress of the new dairy manufacturing plant under F&N Foods (Cambodia) Co., Ltd, located in the Suvannaphum Special Economic Zone, Kandal, is progressing according to plan and scheduled to commence operations in early 2026.

Meanwhile, F&B Malaysia’s new beverage plant in Butterworth, Penang commenced operations in August 2025, producing carbonated soft drinks and drinking water for markets in Northern Peninsular Malaysia, thereby reducing the carbon footprint previously incurred by transporting goods manufactured in the Shah Alam main plant.

In line with rising health and wellness trends, the Group continued to strengthen its portfolio with new innovations across key categories. Highlights in FY2025 included F&N Magnolia 100% Fresh UHT in liquid milk, F&N NutriWell in plant-based beverages, and new zero-sugar options such as F&N Sparkling Zero and 100PLUS Power Peach. OYOSHI Chakulza also added a refreshing twist with sparkling green tea variants for younger, health-conscious consumers. These innovations reflect the Group’s commitment to evolving consumer lifestyles.

In FY2025, F&NHB continued to advance its ESG priorities through initiatives that delivered meaningful impact for communities and the environment. At the integrated dairy farm in Gemas, community programmes reached over 5,000 people in collaboration with local authorities and agencies. The Group also contributed to the Ministry of Education’s Program Susu Sekolah, supporting over 85,000 students across Melaka, Negeri Sembilan and Johor with nutritious fresh milk. On the environmental front, F&NHB achieved 100% Certified Sustainable Palm Oil (CSPO) usage across all operations and contributed over 20,000 kg of food to vulnerable communities through long-term NGO partnerships. These efforts earned the Group the Gold Award in the Consumer Products and Services category at The Edge ESG Awards 2025.

Chairman Y.A.M. Tengku Syed Badarudin Jamalullail said, “At F&NHB, we believe businesses should lead with empathy and purpose — supporting the underserved and helping Malaysians achieve their full potential, in line with our values of building a better business, a better society, and a better planet.”

GOING FORWARD

Reflecting on the Group’s outlook for FY2026, Lim said, “In 2026, we are excited to celebrate F&NHB’s 60th anniversary in East Malaysia, marking a significant milestone – six decades since the commencement of our operations in 1966.

“To date, our presence has grown to four manufacturing facilities in Kota Kinabalu, Matang and Kuching, supported by seven sales offices in both states. As we commemorate this milestone, we reaffirm our enduring commitment to East Malaysia and its diverse communities in growing together, then, now, and always,” he added.

Lim summarised, “Looking ahead, as a Group, we remain committed to long-term growth through strategic investments that broaden our consumer reach and reduce environmental impact. Strategic initiatives such as F&N AgriValley reflect our ambition to offer Malaysians world-class fresh milk at affordable prices and contribute to the nation’s food security goals. While these investments may temporarily affect margins, we are confident with the potential returns in line with our plans and milestone targets.”

The Board proposed a final single-tier dividend of 35.0 sen per share (FY2024: final dividend of 33.0 sen per share) amounting to approximately RM128.4 million (FY2024: RM121.0 million), for the financial year ended 30 September 2025.

Subject to shareholders’ approval at the forthcoming Annual General Meeting, the total dividend for the year would amount to 65.0 sen per share (FY2024: total dividend of 63.0 sen per share), bringing the total dividend payout for FY2025 to RM238.4 million (FY2024: RM231.1 million).